Why “Complexity” Doesn’t Increase With Age — It Shifts

As more traditional planners explore Total Wealth Planning, a recurring tension often surfaces:

“Planning becomes more complex as clients get older.”

It’s a reasonable assumption.

It’s also incomplete.

What actually changes over a lifetime is not the level of complexity, but the composition of wealth — and therefore where complexity sits.

This article explores that shift and why it matters for planners transitioning from traditional, financial-capital-led advice to a Total Wealth approach.

The inherited assumption many planners carry

Most planners are trained within a framework where:

- Wealth is defined as financial capital

- Planning means modelling money

- Complexity is associated with tax, sequencing, longevity, and drawdown risk

From that perspective, it’s natural to conclude:

- Younger clients are “simple”

- Older clients are “complex”

That conclusion only holds true if financial capital is the only form of wealth being considered.

Total Wealth Planning expands the frame.

The Total Wealth perspective

At the Academy of Life Planning, we work from a simple definition:

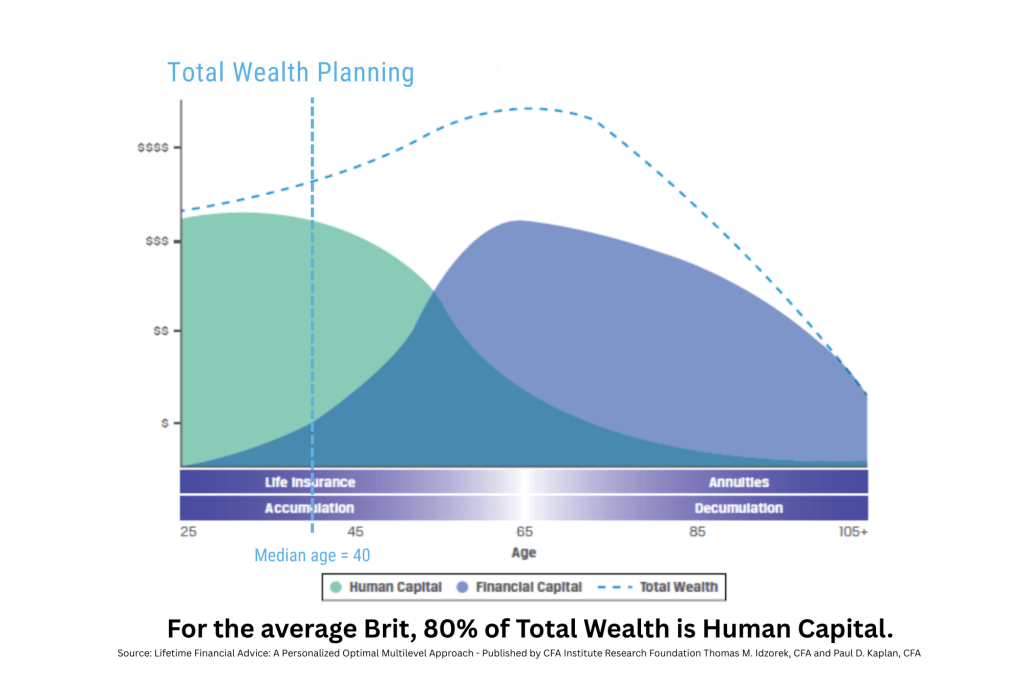

Total Wealth = Human Capital + Financial Capital

Once this is understood, a subtle but important shift occurs:

Complexity does not increase with age.

The dominant form of wealth simply changes.

Early and mid-career clients (roughly 25–45)

From a traditional viewpoint, these clients are often described as:

- “Too early for planning”

- “Simple cases”

- “Primarily accumulation-focused”

Financially, that may be true.

But from a Total Wealth perspective, this is often the most complex and consequential stage of planning.

Their human capital is:

- Highly valuable

- Highly flexible

- Highly exposed to both risk and opportunity

Key areas of complexity include:

- Career direction and optionality

- Skill development and earning trajectory

- Health, energy, and resilience

- Identity, motivation, and meaning

- Portfolio careers, entrepreneurship, and side projects

- Time-for-money trade-offs

This is the phase where:

- Most lifetime wealth is actually created

- Poor human-capital decisions are hardest to unwind later

- Traditional financial tools add the least value

The planning challenge here isn’t how much money exists, but how a person deploys themselves over time.

Midlife transition clients (roughly 45–60)

This group is often misunderstood.

Financial capital is growing.

Human capital is still strong — but evolving.

Complexity here is dual-layered:

- Financial decisions carry more weight

- Human capital needs redesign, not just optimisation

Common themes include:

- Burnout or misalignment

- Career plateau or reinvention

- Business creation or exit

- Rebalancing income, health, and meaning

- Preparing for a second or third chapter of work

Traditional planning often jumps quickly to:

“When can you afford to retire?”

Total Wealth Planning asks first:

“How do you want to deploy the next 10–20 years of capability — and why?”

The complexity hasn’t increased.

It has changed form.

Later life and retirement (60+)

This is where traditional planners are most comfortable — and rightly so.

Financial capital complexity is real and important:

- Drawdown sequencing

- Tax efficiency

- Longevity and inflation risk

- Intergenerational planning

Human capital hasn’t disappeared, but it takes a different shape:

- Contribution

- Mentorship

- Legacy

- Purpose beyond paid work

- Stewardship rather than accumulation

Here, financial modelling plays a larger role —

but it still supports life decisions, rather than replacing them.

Where the tension really comes from

The unease many planners feel during this transition isn’t about competence.

It’s about identity.

Most planners have spent years mastering:

- The financially visible portion of wealth

- What can be modelled, optimised, and defended

Total Wealth Planning asks planners to:

- Treat human capital as the primary asset for much of life

- Facilitate thinking, not just calculate outcomes

- Be comfortable working with uncertainty, narrative, and possibility

That’s a shift in posture, not a rejection of professional rigour.

Why this matters for your practice

When planners assume complexity only increases with age, they often:

- Under-serve younger clients

- Over-financialise midlife transitions

- Miss their most transformative work

When planners understand that complexity moves, they can:

- Add deep value earlier in life

- Build longer-term, trust-based relationships

- Position themselves as life planners, not just retirement specialists

A more accurate conclusion

Total Wealth Planning doesn’t discard traditional financial planning.

It completes it.

The mistake isn’t recognising complexity.

It’s assuming it always lives in the same place.

Wealth doesn’t become more complex with age.

It changes its shape.

And when planners learn to plan for the whole shape of wealth — human and financial — their work becomes not only more effective, but more meaningful.