By Steve Conley | 9 July 2025

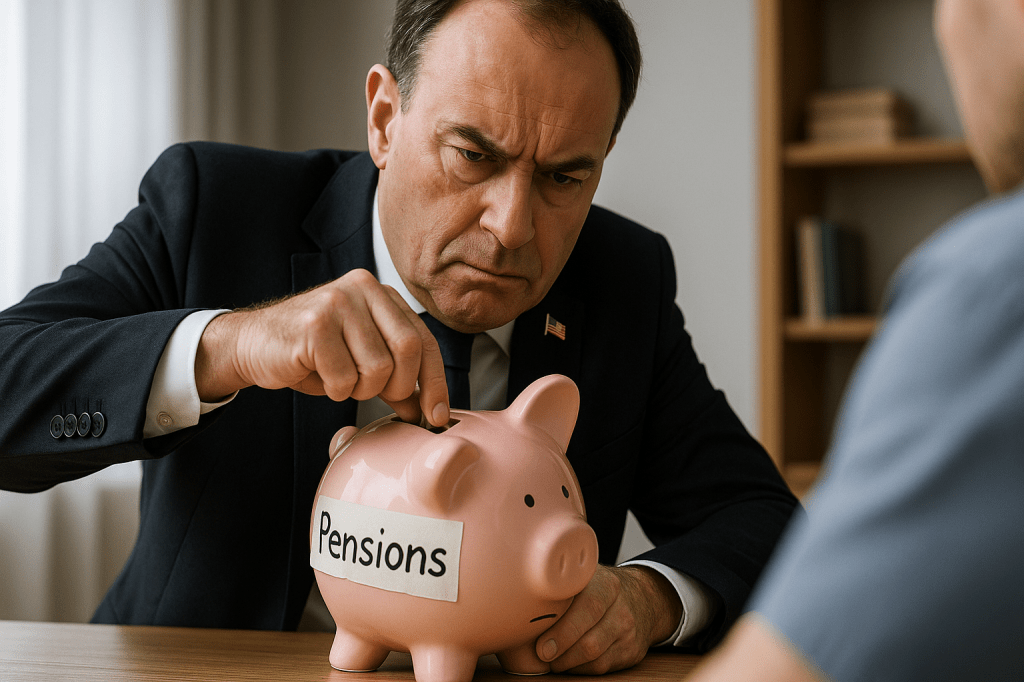

This week, Parliament debated the new Pension Schemes Bill—a bill that, if passed, would allow government ministers to direct how private pension funds are invested. It’s being sold as a benign “backstop,” but to many in the profession, it looks less like reform and more like requisition.

Bank of England governor Andrew Bailey has now broken ranks with the government, calling out the dangers of state interference in pension investment. In his words:

“I do not support mandating — I don’t think that’s appropriate.”

And he’s right.

While there is broad agreement that pension money should be working harder for the economy—and for the members it serves—imposing targets or mandates fundamentally undermines the fiduciary role of trustees. It turns retirement savings into a political slush fund.

Let’s be clear: pensions aren’t a nationalised piggy bank.

🏗️ The Mansion House Mirage

Under the Mansion House Accord, seventeen major DC providers voluntarily pledged to invest 10% in private markets, with at least 5% in UK-based projects. But the Pension Schemes Bill threatens to shift that from aspiration to obligation.

It’s one thing to encourage productive finance—it’s quite another to engineer it by ministerial decree.

This new clause gives ministers sweeping powers to tell schemes how to invest—undermining trustee independence, exposing members to political risk, and fundamentally reframing the purpose of pensions: from providing lifetime security to propping up short-term growth agendas.

🎯 The Misdiagnosis: Capital Without People

The government’s narrative centres on “unlocking billions” to fuel UK growth. But it misses the elephant in the room: human capital. Older adults aren’t just retirement liabilities—they’re assets. Many continue working, contributing, and building businesses well past state pension age.

Cliff-edge retirement is outdated. So is the notion that our salvation lies in channelling financial capital into illiquid, high-fee markets, while ignoring the vast underutilised human capacity in later life.

⚖️ Trustees Know Best

Steve Webb, former pensions minister, called Bailey’s remarks a “nuclear” intervention. But let’s call it what it is: a necessary reality check.

As Webb rightly stated:

“It is ultimately for trustees to decide how to invest in the best interests of their members.”

The governor’s opposition is more than symbolic—it highlights the constitutional boundary being crossed. If this clause survives scrutiny, it could set a dangerous precedent: government ministers picking winners and losers with your retirement savings.

🌱 A Better Way

Instead of coercion, the government should focus on true reform:

- Empower trustees through better data, tools, and training.

- Encourage sustainable, transparent investments through incentives, not threats.

- Recognise and support human capital as part of retirement strategy.

- Foster trust—not force—in how pensions serve society.

We need pensions to be for the people, not for the Treasury.

If the government wants investment in the UK, it must make the UK investable—not raid the nest eggs of ordinary savers to mask structural failings in economic policy.

🗣️ Have thoughts on the Pension Schemes Bill? Share your perspective and help protect the independence of trustees and the security of future retirees.

Your Money or Your Life

Unmask the highway robbers – Enjoy wealth in every area of your life!

By Steve Conley. Available on Amazon. Visit www.steve.conley.co.uk to find out more.