Artificial intelligence is about to become your new financial intermediary.

Not in a branch.

Not in a suit.

Not even on a Zoom call.

But embedded quietly inside the apps, platforms, and “smart assistants” that will soon recommend what you save, what you invest, what you insure, what you borrow — and eventually what you do with your life.

The FCA’s latest AI review recognises this shift. It calls it “agentic AI” — systems that don’t just explain options, but recommend actions and execute decisions on your behalf.

That’s either the greatest leap forward in financial empowerment in a generation.

Or the most subtle form of intermediation ever created.

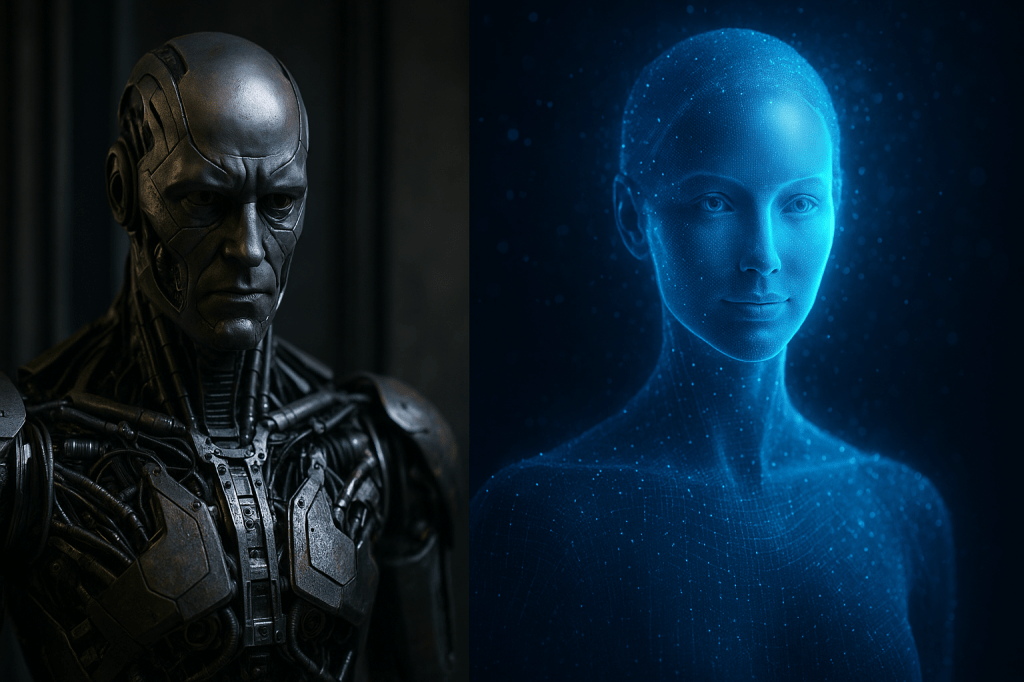

Two Futures. One Fork in the Road.

There are only two structurally different paths this can take.

Path 1: AI as a Liberation Tool

In this future, AI becomes a sovereignty amplifier.

It helps people:

- Clarify their life goals before their financial goals

- Optimise around wellbeing, not just returns

- Understand trade-offs in plain English

- Build plans without product bias

- Own their own data and planning logic

- Make decisions with AI — not be nudged by it

Here, AI replaces dependence with agency.

It decentralises planning power.

It treats human potential as a primary asset class.

This is the future the Academy of Life Planning is building toward.

Path 2: AI as Invisible Intermediation

In this future, AI becomes a commercial proxy.

It lives inside:

- Banks

- Insurers

- Investment platforms

- Big-tech ecosystems

It optimises for:

- Margin

- Product placement

- Retention

- Balance-sheet efficiency

- Cross-sell

- Regulatory defensibility

Its logic is opaque.

Its incentives are misaligned.

Its nudges are invisible.

It doesn’t ask:

“What kind of life do you want to live?”

It asks:

“What is the most commercially efficient next move for this user profile?”

This isn’t advice.

It isn’t empowerment.

It’s automation of the same old extraction model — just faster, quieter, and harder to audit.

The Real Risk Isn’t AI. It’s Structural Trust.

The FCA says it will rely on existing rules like the Consumer Duty to manage AI risks.

That sounds reassuring.

But it misses the deeper problem:

You cannot regulate your way out of a misaligned optimisation engine.

If an AI system is designed to serve institutional growth first and consumer wellbeing second, no amount of disclosure language or principles-based oversight will fix that.

The real regulatory fault line isn’t “AI vs no AI”.

It’s:

- Structurally trustworthy AI

vs - Commercially optimised AI

Until regulators name that distinction explicitly, the default outcome will be capture by incumbents and platforms — not liberation for citizens.

Why This Matters Now

The advice boundary is already breaking.

When AI starts acting as your “personal intermediary”, three things change overnight:

- The old “advice vs guidance” framework collapses

- Product-led business models lose their monopoly on decision influence

- The centre of gravity shifts from institutions to interfaces

Whoever controls the interface controls the future of financial agency.

That’s why this moment matters.

The AoLP Position

At the Academy of Life Planning, we are building and testing a different model:

- AI as a co-planner, not a proxy

- Life goals before financial products

- Human capital before financial capital

- Transparent logic over opaque optimisation

- Non-intermediated planning by design

- Done-by-you first. Done-with-you when needed. Done-for-you only as a support layer.

We believe the future of planning is not:

“Trust the machine.”

It is:

“Use the machine to reclaim your agency.”

The Question Regulators, Firms, and Citizens Must Now Answer

Will agentic AI become:

- A tool for mass financial self-sovereignty?

Or:

- The next invisible layer of algorithmic intermediation —

optimised for growth, shielded by complexity, and immune to meaningful accountability?

The technology itself is neutral.

The architecture is not.

And the choices being made right now will quietly lock in the answer for a generation.

The future of planning will be either:

- Transparent, human-centred, and empowering

or - Invisible, extractive, and automated.

There is no stable middle ground.

And this time, we get to choose —

if we’re paying attention.

Discover more at the Academy of Life Planning.