How Structural Untrustworthiness Forces the Public to Foot the Bill

Every few years, the public is told there’s a “black hole” in the nation’s finances. Productivity has fallen. Growth has stalled. The deficit has widened.

And every time, the remedy is the same: raise taxes, cut services, and tighten belts.

But what if the real deficit isn’t fiscal — it’s moral?

What if the shortfall in our public finances is a direct consequence of a financial system that extracts value instead of creating it?

🏦 The Hidden Cost of Structural Untrustworthiness

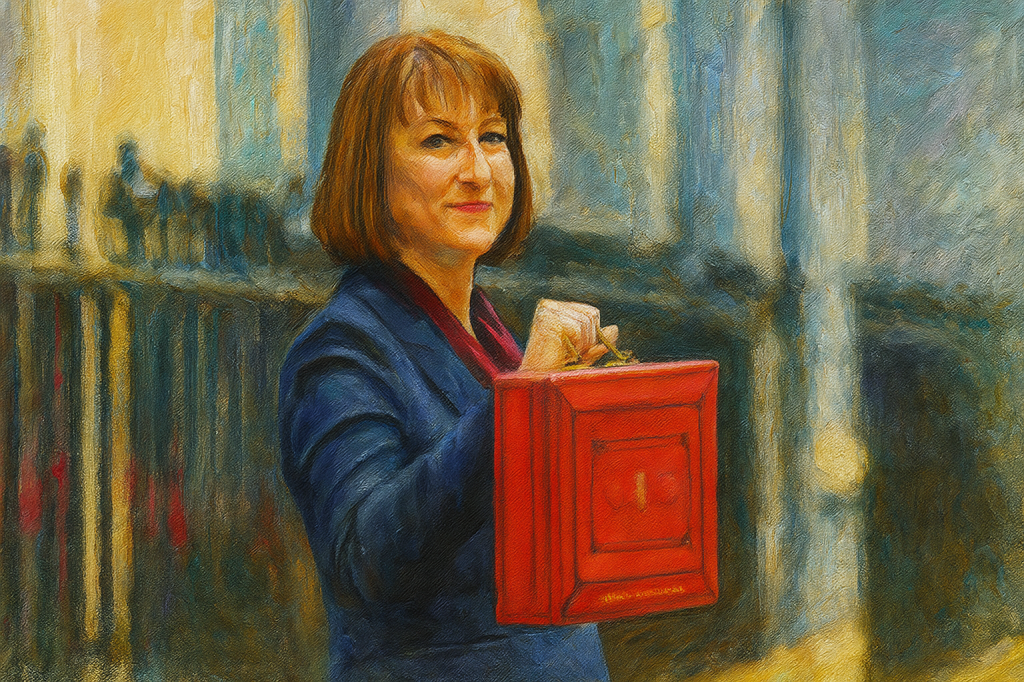

Chancellor Rachel Reeves’ plan to raise the basic rate of income tax by 2 pence would make her the first chancellor in half a century to do so.

She argues it’s necessary to fill a £30 billion gap in the public purse after the Office for Budget Responsibility downgraded productivity forecasts.

But that gap didn’t appear out of thin air.

It’s the accumulated cost of decades of structurally untrustworthy finance — a system designed to serve itself first and the public last.

Every pound lost to hidden commissions, opaque fees, reckless lending, and redress schemes that protect institutions instead of victims becomes a pound the Exchequer must later replace through taxation.

When the system privatises profit and socialises loss, citizens end up paying twice: once through financial exploitation, and again through higher taxes.

⚖️ From SUD to STP — the Real Reform Britain Needs

💰 The Structurally Untrustworthy Discount (SUD)

The SUD is the devaluation penalty markets apply when financial institutions and policymakers act without fiduciary integrity.

It represents the discount on the valuation of financial stocks — and, by extension, on GDP and national prosperity — that arises when trust is eroded.

Bad bankers create bad balance sheets, not just for themselves but for the whole economy.

When governance is opaque, incentives misaligned, and exploitation tolerated, investors price in risk, consumers withdraw confidence, and governments are left to fill the gap through higher taxes and public borrowing.

📈 The Structurally Trustworthy Premium (STP)

The STP is the valuation uplift that accrues when finance operates on transparency, accountability, and fiduciary duty.

It is the premium investors reward to high-trust institutions and economies whose systems are structurally sound, ethically governed, and focused on long-term value creation.

High-trust organisations consistently outperform — Gallup finds 20 % higher productivity and 21 % greater profitability — and nations built on that same trust logic enjoy stronger markets, higher GDP, and more resilient public finances.

🧭 The Bigger Picture

When we tolerate the SUD, we all pay the price — through lower market valuations, weaker growth, and now, another 2p in income tax.

When we invest in the STP, everyone benefits — shareholders, citizens, and the state alike.

The solution to Britain’s fiscal deficit isn’t another tax rise; it’s a trust rise.

Structural trustworthiness isn’t just a moral virtue — it’s an economic strategy.

If financial services operated under a universal fiduciary duty to the consumer, those hidden costs — mis-selling scandals, bailouts, compensation schemes, enforcement budgets — would disappear.

So would much of the need for fiscal patch-ups like Reeves’ tax rise.

Imagine an economy built on the STP principle — where firms compete not to extract, but to empower.

Where “return on trust” replaces “return on leverage.”

Where planners, advisers, and institutions are rewarded for long-term well-being, not short-term churn.

That is how you rebuild structural trustworthiness — and that is how you repair the public finances without raising taxes.

💡 A Fiduciary Nation

When financial services act in the best interests of the public, the benefits ripple outward:

- Productivity rises as households regain confidence and security.

- Growth becomes sustainable rather than speculative.

- The Treasury collects fair, stable revenue instead of crisis surcharges.

Reeves’ 2p income-tax rise is not a sign of fiscal prudence; it’s an invoice for institutional irresponsibility.

Britain doesn’t need another tax hike. It needs a new social contract — one grounded in structural trustworthiness.

🧭 The Way Forward

The Academy of Life Planning trains planners to model the fiduciary standard that the wider system lacks.

We call it The GAME Plan — a framework for rebuilding life, business, and policy on principles of integrity, purpose, and empowerment.

If government truly wants to plug the deficit, it should start not with higher rates, but with higher standards.

A fiduciary duty across all financial services would achieve more than any budget adjustment — and it wouldn’t cost taxpayers a penny.

Call to Action:

Join the movement for Structurally Trustworthy Finance.

Learn how to plan your life — and your nation’s future — around integrity, not extraction.

👉 academyoflifeplanning.com

Get SAFE Exists to Change That

Get SAFE (Support After Financial Exploitation) is building a national lifeline for victims — providing free emotional recovery, life-planning, and justice support through our:

- Fellowship: peer-to-peer recovery and community.

- Witnessing Service: trauma-informed advocacy for those seeking redress.

- Citizen Investigator Training: empowering survivors to uncover truth and pursue justice.

Our Goal: Raise £20,000 to Rebuild Lives

Your contribution will help us:

Register Get SAFE as a charity (CIO)

Build our website, CRM, and outreach platform

Fund our first year of free recovery and justice programmes

Every £50 Changes a Life

Each £50 donation funds a bursary for one survivor — giving them access to the tools, training, and community that restore confidence, purpose, and hope.

This Isn’t Just a Fundraiser — It’s a Movement

We’re reclaiming fairness and rebuilding trust, one life at a time.

Support the Crowdfunder today

Be part of the movement to rebuild lives and restore justice.